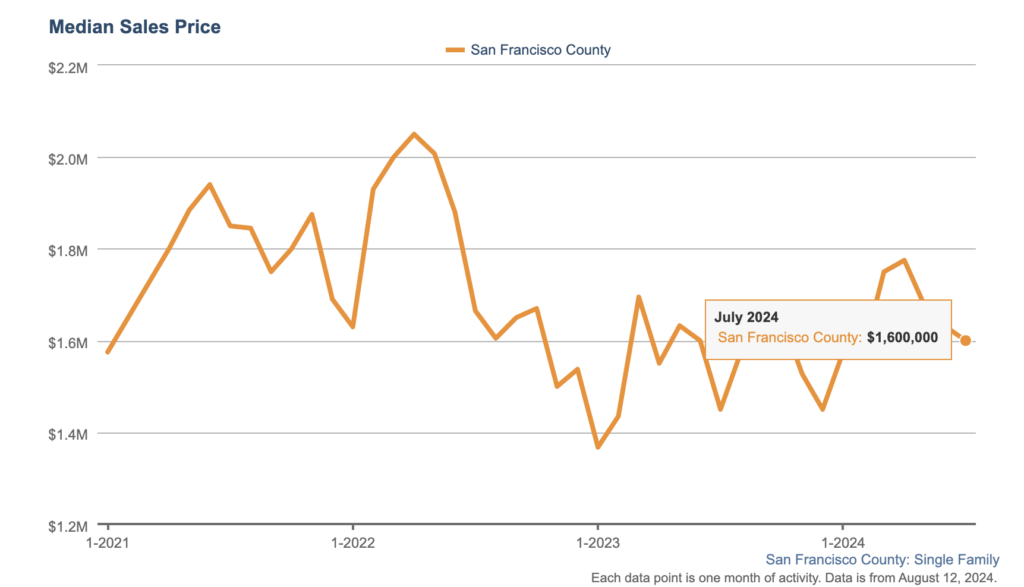

The San Francisco real estate market has experienced significant fluctuations in recent years, with prices reaching record highs followed by periods of cooling demand. As of 2024, the median home price in San Francisco stands at $1.6 million, a figure that has remained relatively stable over the past year.

However, this price point is still out of reach for many, as the city continues to grapple with a severe housing shortage and affordability crisis.

Here’s a quick snapshot of how median sales prices for single family have evolved over the past few years!

Source: San Francisco Association of Realtors

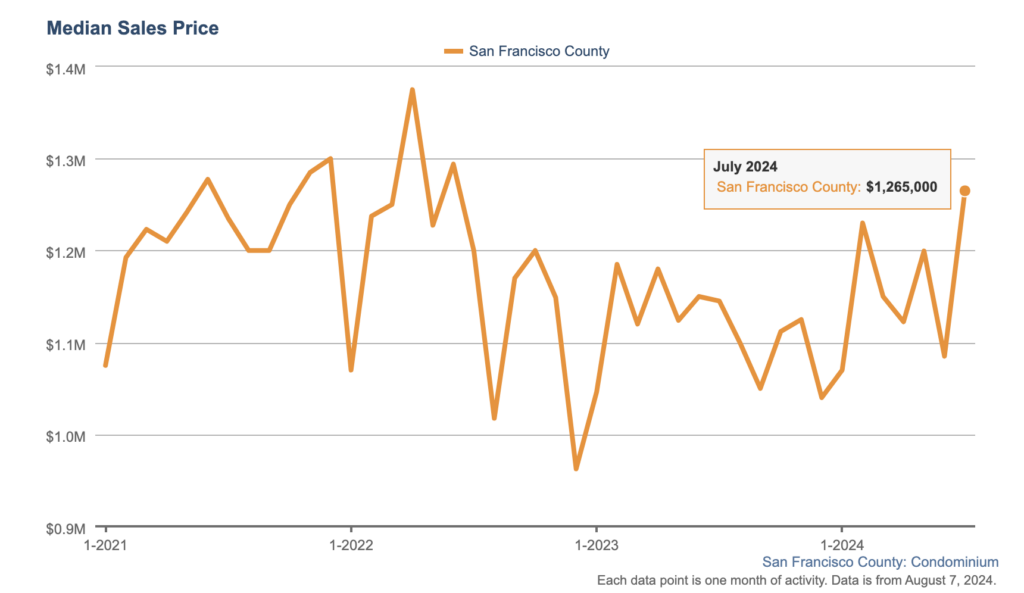

Here’s a quick snapshot of how median sales prices for condominium have evolved over the past few years!

Source: San Francisco Association of Realtors

One of the key factors driving the high prices in San Francisco is the limited supply of available homes.

The city’s geographic constraints, strict zoning laws, and slow pace of new construction have made it difficult for the housing market to keep up with the growing population and demand.

This imbalance between supply and demand has led to fierce competition among buyers, often resulting in bidding wars and properties selling well above the asking price.

Like homes in the Sunset District of San Francisco frequently sell for over 20% above their listed prices due to several key factors:

- High Demand and Limited Supply: The popularity of the Sunset District combined with a limited number of homes for sale creates intense competition among buyers.

- Competitive Market: The area is known for its competitive housing market, resulting in multiple offers on many properties.

- Overbidding: Buyers often engage in overbidding, with homes selling significantly above the asking price.

- Quick Sales: Properties tend to sell quickly, often going pending in just a couple of weeks.

- Desirable Location: The Sunset District offers a safe environment and relatively affordable single-family homes compared to other parts of San Francisco.

For instance, consider a home listed at $1,500,000 in the Sunset District. Due to the factors mentioned above, this property could attract multiple offers and ultimately sell for $1,800,000, representing a 20% increase over the asking price. In some cases, especially for highly sought-after properties, the final sale price could reach $2,000,000, translating to a 33% premium over the original listing. This showcases the dynamic and competitive nature of the Sunset District real estate market.

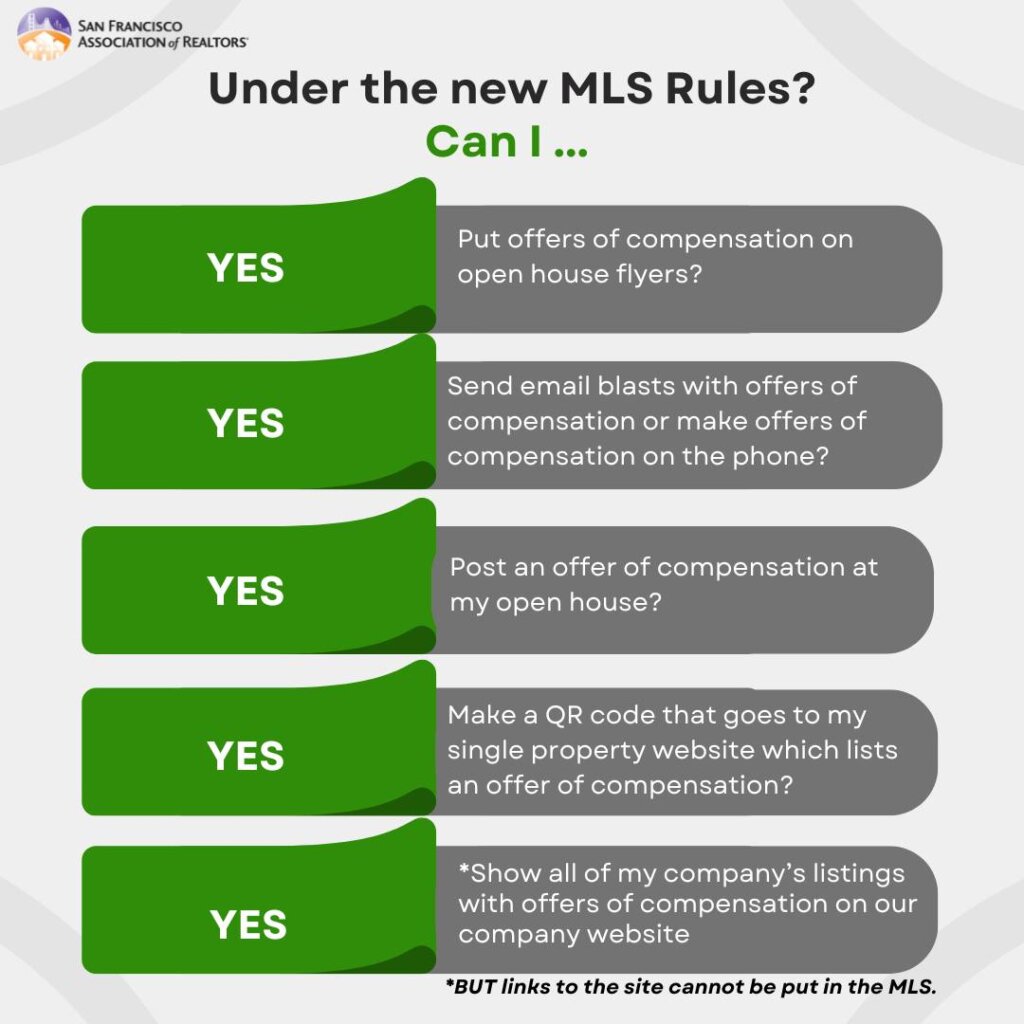

Recent policy changes in the San Francisco real estate market, particularly those related to Multiple Listing Service (MLS) practices, are poised to have a significant impact on home prices.

Here are the key changes and their potential effects:

1. Elimination of Compensation Offers:

The new MLS policies prohibit any offers of compensation to buyer brokers within MLS listings.

This means that listing brokers can no longer advertise how much they are willing to pay buyer agents for bringing in clients.

This change aims to promote transparency but may also reduce the incentive for buyer agents to show certain properties, potentially affecting demand.

2. Mandatory Written Buyer Agreements:

Agents are now required to enter into written agreements with buyers before showing homes. These agreements must clearly disclose the compensation structure, which could lead to more informed buyers but may also complicate the buying process.

NAR has clarified the circumstances under which a written agreement is necessary and when it isn’t, as well as what it may entail.

One key point of clarification relates to what constitutes an agent “working with” a buyer, triggering the need for a formal agreement.

According to NAR, agents can still promote their services to buyers or engage in discussions with potential homebuyers on behalf of a seller without requiring an agreement.

In general, if an agent is not providing specific services and does not anticipate receiving payment for their activities, a buyer agreement is not mandatory.

However, activities such as conducting home tours or arranging showings do necessitate a written contract.

It’s important to note that this contract can be short-term and does not necessarily involve the payment of fees. For instance, Zillow’s recently introduced “touring agreement” serves as an example of an arrangement that complies with these new guidelines.

3. No Compensation Filtering:

Based on Current Listings, Section 21: Non-filtering of Listings. MLS participants cannot filter listings based on the level of compensation offered to cooperating brokers.

This aims to ensure that all listings are treated equally in the marketplace, but it may also lead to less competitive pricing strategies among sellers.

4. Increased Transparency:

The policies mandate that sellers and buyers are informed that broker compensation is negotiable and not set by law. This could empower buyers to negotiate better terms, potentially influencing overall market dynamics.

Here’s an infographic from SFRealtors detailing the new MLS policy

On August 17, 2024, the National Association of Realtors will implement practice changes as a result of NAR’s Settlement Agreement, resolving claims brought on behalf of home sellers related to broker commissions. The implementation will apply nationwide and affects NAR members, real estate professionals, and consumers.

Impact on Home Prices

- Potential Decrease in Buyer Activity: With the elimination of compensation offers, buyer agents may be less motivated to show homes that do not provide compensation. This could lead to a decrease in buyer activity for certain listings, particularly those that are less desirable or priced higher.

- Market Adjustments: As agents adapt to the new policies, there may be a period of adjustment where home prices could stabilize or even decrease in response to changing buyer behavior. Sellers may need to reconsider their pricing strategies to attract buyers without the incentive of broker compensation.

- Increased Negotiation Power for Buyers: With greater transparency regarding compensation, buyers may feel more empowered to negotiate lower prices or better terms. This could lead to a more competitive market where home prices are more reflective of actual market value rather than inflated by commission structures.

- Long-term Market Effects: Over time, these changes could lead to a more balanced market, potentially improving affordability for buyers. However, if the policies result in reduced inventory or less engagement from buyer agents, it could counteract these benefits and keep prices high.

The recent MLS policy changes in San Francisco are likely to reshape the real estate landscape significantly. While the immediate effects on home prices may be mixed, the long-term implications could lead to a more transparent and equitable market. Stakeholders, including buyers, sellers, and real estate agents, will need to navigate these changes carefully to adapt to the evolving dynamics of the San Francisco real estate market.